Understanding Smart Contracts: A Technical Deep Dive

Smart contract architecture visualization showing decentralized execution flow

The Foundation of Smart Contracts

At their core, smart contracts are programmable agreements that execute automatically when predetermined conditions are met. Unlike traditional contracts that require human interpretation and enforcement, smart contracts leverage blockchain technology to create immutable, transparent, and self-enforcing digital agreements. This innovation fundamentally transforms how we approach trust, verification, and automated execution in decentralized systems.

The concept emerged from the need to eliminate intermediaries in digital transactions while maintaining security and reliability. By encoding business logic directly into blockchain networks, smart contracts enable parties to interact with confidence, knowing that the agreed-upon terms will execute precisely as programmed, without possibility of manipulation or selective enforcement.

Decentralized blockchain network infrastructure supporting smart contract execution

Technical Architecture and Execution

Code Structure and Deployment

Smart contracts are typically written in specialized programming languages designed for blockchain environments. The most prominent example is Solidity, which compiles to bytecode that executes on the Ethereum Virtual Machine (EVM). This bytecode is then deployed to the blockchain, where it receives a unique address and becomes permanently accessible to network participants.

The deployment process involves several critical steps. First, developers write and test the contract code in development environments. Once thoroughly vetted, the contract is compiled and submitted to the blockchain through a transaction. This deployment transaction includes the contract bytecode and any initialization parameters, creating an immutable instance that will execute according to its programmed logic.

Key Technical Components

- State Variables:Persistent data stored on the blockchain that maintains contract state between function calls

- Functions:Executable code blocks that define contract behavior and can modify state or return values

- Events:Logging mechanisms that emit information about contract execution for external monitoring

- Modifiers:Reusable code snippets that enforce conditions before function execution

Execution Environment and Gas Economics

Smart contracts execute within a deterministic virtual machine environment that ensures consistent results across all network nodes. This execution model requires computational resources, which are measured and paid for through a system called "gas." Each operation in a smart contract consumes a specific amount of gas, creating an economic mechanism that prevents infinite loops and incentivizes efficient code.

The gas system serves multiple purposes in blockchain networks. It compensates validators for computational work, prevents denial-of-service attacks by making spam expensive, and encourages developers to write optimized code. Understanding gas costs is crucial for building practical smart contracts that remain economically viable for users while maintaining necessary functionality.

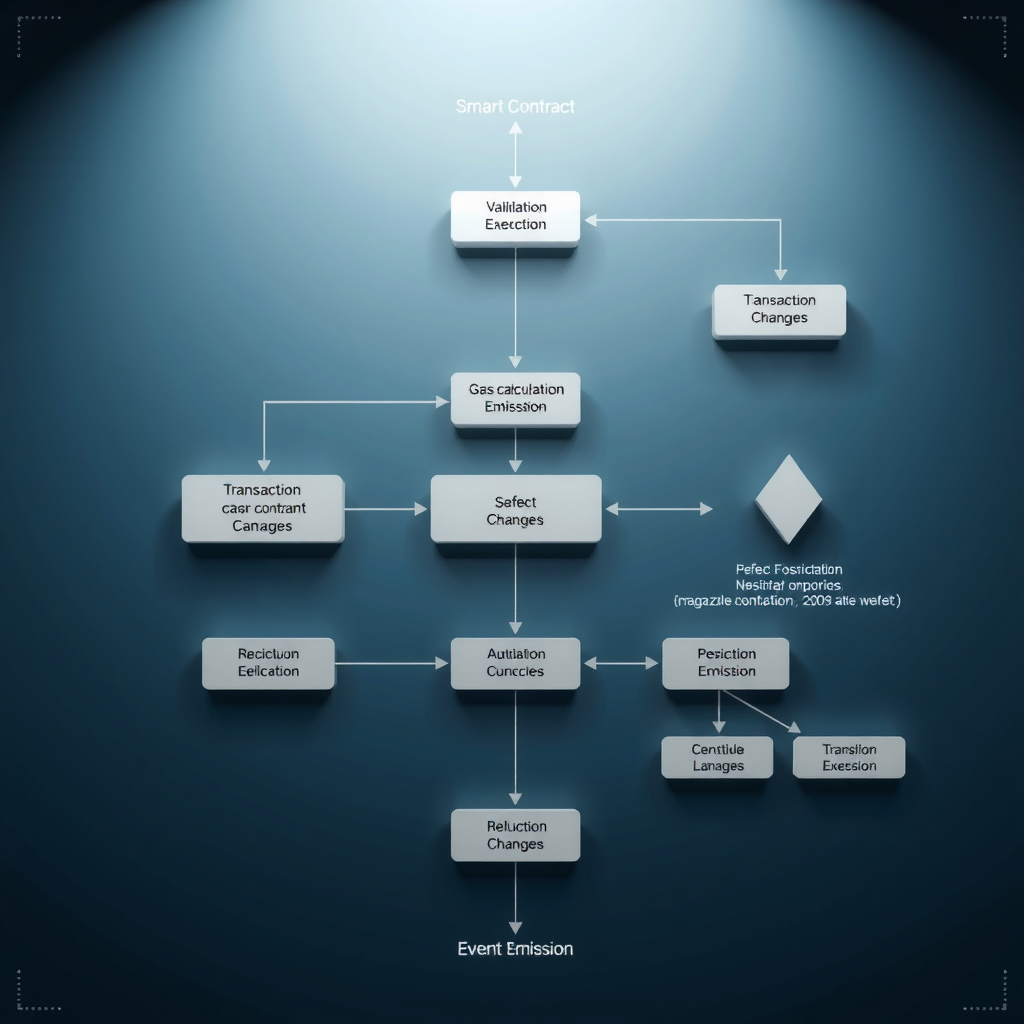

Complete execution flow of smart contract transactions on blockchain networks

Security Considerations and Best Practices

Security represents the paramount concern in smart contract development. Once deployed, contracts become immutable, meaning vulnerabilities cannot be easily patched. This permanence demands rigorous security practices throughout the development lifecycle, from initial design through deployment and ongoing monitoring.

Common Vulnerability Patterns

Several well-documented vulnerability patterns have emerged through years of smart contract development. Reentrancy attacks, where malicious contracts recursively call vulnerable functions before state updates complete, have resulted in significant losses. Integer overflow and underflow issues can cause unexpected behavior in arithmetic operations. Access control failures may allow unauthorized parties to execute privileged functions.

Front-running attacks exploit the public nature of blockchain transactions, allowing attackers to observe pending transactions and submit competing transactions with higher gas prices. Timestamp dependence creates vulnerabilities when contracts rely on block timestamps for critical logic, as miners have limited ability to manipulate these values. Understanding these patterns enables developers to implement appropriate safeguards.

Security Development Lifecycle

- Design Phase:Threat modeling and security requirements definition before writing code

- Development Phase:Following established patterns and using security-focused libraries

- Testing Phase:Comprehensive unit tests, integration tests, and fuzzing to identify edge cases

- Audit Phase:Professional security audits by specialized firms before mainnet deployment

- Deployment Phase:Gradual rollout with monitoring systems and emergency response procedures

- Maintenance Phase:Ongoing monitoring, bug bounty programs, and upgrade mechanisms where appropriate

Formal Verification and Testing

Formal verification applies mathematical proofs to demonstrate that smart contracts behave correctly under all possible conditions. This rigorous approach goes beyond traditional testing by proving properties about contract behavior rather than checking specific test cases. While resource-intensive, formal verification provides the highest level of assurance for critical smart contracts handling significant value.

Complementing formal verification, comprehensive testing strategies include unit tests for individual functions, integration tests for contract interactions, and property-based testing that generates random inputs to discover edge cases. Continuous integration pipelines automate these tests, ensuring that code changes don't introduce regressions or new vulnerabilities.

Real-World Applications and Use Cases

Smart contract-enabled supply chain tracking system with blockchain verification

Supply Chain Management

Supply chain applications demonstrate smart contracts' ability to enhance transparency and efficiency in complex multi-party systems. By recording each step of a product's journey on the blockchain, smart contracts create an immutable audit trail that all stakeholders can verify. Automated payments trigger when goods reach specific checkpoints, reducing delays and disputes while ensuring compliance with contractual terms.

These systems integrate with IoT devices that provide real-time data about product location, temperature, and handling conditions. Smart contracts automatically verify that goods meet quality standards throughout transit, triggering alerts or withholding payments if conditions deviate from specifications. This automation reduces manual verification costs while improving product quality and customer satisfaction.

Digital Identity Verification

Smart contracts enable sophisticated digital identity systems that give individuals control over their personal information while facilitating secure verification. Rather than storing sensitive data on centralized servers vulnerable to breaches, blockchain-based identity systems use smart contracts to manage credentials and permissions. Users can selectively disclose specific attributes without revealing unnecessary information.

These decentralized identity solutions support various use cases, from age verification for restricted content to professional credential verification for employment. Smart contracts handle the cryptographic operations that prove identity claims without exposing underlying data, creating privacy-preserving verification mechanisms that work across organizational boundaries.

Industry Adoption Trends

Financial Services:Automated lending protocols, decentralized exchanges, and programmable payment systems

Healthcare:Patient data management, clinical trial tracking, and insurance claim processing

Real Estate:Property tokenization, automated escrow, and fractional ownership systems

Government:Voting systems, public records management, and regulatory compliance automation

Decentralized Finance (DeFi)

The decentralized finance ecosystem represents perhaps the most mature application of smart contract technology. DeFi protocols use smart contracts to recreate traditional financial services without intermediaries, enabling lending, borrowing, trading, and asset management through automated code execution. These systems operate transparently, with all transactions visible on the blockchain and rules encoded in verifiable smart contracts.

Automated market makers use mathematical formulas encoded in smart contracts to facilitate token exchanges without order books. Lending protocols automatically match borrowers with lenders, calculating interest rates based on supply and demand. Yield farming strategies compose multiple smart contracts to optimize returns, demonstrating the composability that makes DeFi protocols powerful building blocks for financial innovation.

Future Developments and Challenges

Smart contract technology continues evolving rapidly, with ongoing research addressing current limitations and expanding capabilities. Scalability improvements through layer-2 solutions and sharding enable higher transaction throughput while maintaining security. Cross-chain interoperability protocols allow smart contracts on different blockchains to communicate, creating more connected decentralized ecosystems.

Privacy-preserving smart contracts using zero-knowledge proofs enable confidential transactions while maintaining verifiability. These advances address concerns about blockchain transparency in business applications where competitive information must remain private. Formal verification tools become more accessible, helping developers prove contract correctness without specialized mathematical expertise.

Vision of future blockchain infrastructure with advanced smart contract capabilities

Regulatory frameworks for smart contracts remain in development, with governments worldwide working to balance innovation with consumer protection. Legal recognition of smart contract execution as binding agreements varies by jurisdiction, creating challenges for cross-border applications. Industry standards for smart contract development, auditing, and deployment continue maturing, improving overall ecosystem security and reliability.

The integration of artificial intelligence with smart contracts opens new possibilities for adaptive systems that respond to changing conditions. Oracle networks that provide reliable external data to smart contracts become more sophisticated, enabling contracts to react to real-world events with greater accuracy. These developments expand the range of applications where smart contracts can provide value while maintaining the security and transparency that make blockchain technology compelling.

Conclusion

Smart contracts represent a fundamental shift in how we conceptualize and implement automated agreements. By combining cryptographic security, decentralized execution, and transparent verification, they enable new forms of coordination and value exchange that were previously impossible or impractical. Understanding their technical architecture, security considerations, and practical applications provides essential knowledge for anyone working with blockchain technology.

As the technology matures and adoption grows, smart contracts will increasingly underpin critical infrastructure across industries. Their ability to automate complex processes while maintaining security and transparency makes them valuable tools for building more efficient, trustworthy systems. The ongoing evolution of smart contract platforms, development tools, and best practices continues expanding what's possible in decentralized applications.

The future of smart contracts lies not just in technological advancement, but in thoughtful application of these tools to solve real problems while maintaining the security, transparency, and decentralization that make blockchain technology transformative.